Sure, here’s a unique and detailed introduction for your blog Navigating the Forex Market: The Importance of Backtesting:

In the vast and volatile world of foreign exchange trading, or Forex as it’s more commonly known, success often hinges on the ability to predict the unpredictable. Traders around the globe are constantly seeking strategies to forecast market movements and gain an edge over their competition. One such strategy, often overlooked yet incredibly valuable, is backtesting.

Backtesting, in its simplest form, is the process of testing a trading strategy using historical data. It allows traders to simulate what would have happened had they implemented a particular strategy during a previous time period. This powerful tool can provide invaluable insights, helping traders to understand potential outcomes of their strategies before risking real money in the live market.

This blog aims to delve deep into the realm of backtesting, exploring its importance in navigating the Forex market. We’ll demystify the concept, walk you through the process, discuss its role in trading, and even touch upon its risks and limitations. We’ll also guide you on how to backtest strategies for free, and how to do so on different platforms like TradingView and MT4/MT5.

Whether you’re a seasoned trader or a beginner stepping into the Forex market, understanding the importance of backtesting could be the key to your trading success. So, let’s embark on this journey of discovery together, and unlock the potential that backtesting holds for your trading strategies. Welcome to “Navigating the Forex Market: The Importance of Backtesting”. Let’s get started!

Understanding Backtesting

What is backtesting?

Backtesting, a term often heard in the corridors of financial trading, is a method that allows traders to test their trading strategies using historical data. Imagine having a time machine that allows you to travel back to a specific period in the market and apply your trading strategy. You observe the outcomes, make notes, and return to the present. That’s essentially what backtesting does, but without the need for a time machine.

In a backtest, a trading strategy is applied to a set of historical data to see how it would have performed during that time period. This process involves simulating trades based on the strategy’s rules and recording the hypothetical results for analysis. It’s like a dress rehearsal before the actual performance, providing traders with a ‘sneak peek’ into how their strategy might fare in the real market.

Backtesting is a powerful tool in a trader’s arsenal, offering a risk-free environment to test, tweak, and perfect their strategies before deploying them in the live market. It’s an essential step in strategy development, helping traders gain confidence in their system, understand its limitations, and improve its effectiveness.

However, while backtesting is a valuable tool, it’s important to remember that past performance is not always indicative of future results. Market conditions change, and what worked in the past may not necessarily work in the future. Therefore, backtesting should be used as a guide and not a guarantee of future performance. But with careful use, backtesting can be a stepping stone towards more informed and potentially successful trading.

What are the basics of backtesting?

Backtesting, at its core, is a blend of historical analysis and hypothetical application. It’s like a time-travel experiment for your trading strategy, allowing you to see how it would have performed in the past. But before we dive into the complexities, let’s break down the basic components of backtesting:

1. Trading Strategy: This is the blueprint of your trading actions. It includes the conditions under which you enter and exit trades, the assets you trade, and any other rules you follow. Your strategy should be clearly defined and quantifiable to be backtested.

2. Historical Data: Backtesting requires a substantial amount of historical market data. This data should be relevant to the assets you’re trading and cover a sufficient time period to provide meaningful results. The quality of your data can significantly impact the accuracy of your backtest.

3. Simulation: Once you have your strategy and data, you simulate the trades as per your strategy on the historical data. This involves applying your entry and exit rules, managing your portfolio, and recording the trades and their outcomes.

4. Evaluation: After running the simulation, you’ll have a set of results that show how your strategy would have performed. It’s crucial to evaluate these results critically, looking at metrics like net profit, drawdown, win rate, and risk-to-reward ratio.

5. Optimization: Based on your evaluation, you might find areas where your strategy could be improved. This could involve tweaking your entry or exit rules, adjusting your risk management, or even changing the assets you trade.

Remember, backtesting is not a crystal ball that predicts future performance. It’s a tool that helps you understand the potential strengths and weaknesses of your trading strategy based on historical performance. It’s an iterative process of learning, testing, and refining that can help you navigate the unpredictable waters of the financial markets with more confidence and precision.

What is the purpose of backtesting?

The purpose of backtesting lies in its ability to provide a glimpse into the past, allowing traders to test their strategies against historical data. It serves as a time machine of sorts, enabling traders to see how their strategies would have performed under past market conditions. But why is this important? Let’s delve into the key purposes of backtesting:

1. Validation of Trading Strategies: Backtesting allows traders to validate their trading strategies before applying them in real-time. By testing a strategy against historical data, traders can see how it would have performed, providing a level of confidence in its potential success.

2. Improvement of Trading Strategies: Backtesting doesn’t just validate strategies; it also helps improve them. By analyzing the results of a backtest, traders can identify weaknesses in their strategy and make necessary adjustments, thereby enhancing their trading system.

3. Risk Management: Backtesting can help traders understand the level of risk associated with a particular strategy. By analyzing metrics such as maximum drawdown and volatility, traders can better manage their risk and adjust their strategies accordingly.

4. Performance Metrics: Backtesting provides important performance metrics such as win rate, average profit/loss, risk/reward ratio, and more. These metrics can help traders compare different strategies and choose the one that best fits their trading goals and risk tolerance.

5. Learning and Understanding: For new traders, backtesting can be a great learning tool. It can help them understand how different strategies work in various market conditions, thereby enhancing their trading knowledge and skills.

In essence, the purpose of backtesting is to provide traders with a tool to better understand, validate, and improve their trading strategies. It’s like having a practice ground where you can hone your strategies without risking real money, making it an invaluable tool in a trader’s arsenal.

What is EightCap and Why Choose It for Forex Trading?

EightCap is a renowned online Forex and CFD broker that provides a platform for traders to participate in the global financial markets. Established in 2009 and regulated by the Australian Securities and Investments Commission (ASIC), EightCap has built a reputation for its dedication to providing a reliable and user-friendly trading experience.

Choosing EightCap for Forex trading comes with several advantages:

1. Regulated Broker: EightCap is regulated by ASIC, providing traders with a secure and trustworthy trading environment.

2. Wide Range of Trading Instruments: EightCap offers a vast array of trading instruments including Forex, indices, commodities, and shares.

3. Advanced Trading Platforms: EightCap provides access to the popular MetaTrader 4 and MetaTrader 5 platforms, known for their advanced charting tools and automated trading capabilities.

4. Competitive Spreads and Leverage: EightCap offers competitive spreads and high leverage, allowing traders to maximize their trading potential.

5. Educational Resources: EightCap provides a wealth of educational resources for both beginner and experienced traders, helping them to continually improve their trading skills.

6. Excellent Customer Service: EightCap is known for its responsive and helpful customer service, providing support to traders when they need it most.

For a more detailed overview of EightCap’s offerings, you can refer to our comprehensive EightCap Broker Review. This review provides an in-depth analysis of EightCap’s services, helping traders make an informed decision about whether EightCap is the right broker for their trading needs. Remember, choosing the right broker is a crucial step in your trading journey, so take the time to do your research and choose wisely.

The Process of Backtesting

How do you perform backtesting?

Backtesting is a critical process in the development and validation of a trading strategy. It involves simulating trades based on historical data to evaluate the potential effectiveness of a strategy. Here’s a step-by-step guide on how to perform backtesting:

1. Define Your Trading Strategy: The first step in backtesting is to clearly define your trading strategy. This includes the rules for entering and exiting trades, the assets you’re trading, and any other parameters that govern your trading decisions.

2. Collect Historical Data: Once your strategy is defined, you’ll need historical data to test it against. This data should be relevant to the assets you’re trading and cover a sufficient time period to provide meaningful results. The quality and accuracy of your data are crucial for reliable backtesting.

3. Set Up Your Backtesting Environment: Depending on your level of expertise, you can use a ready-made backtesting software or build your own. The backtesting environment should allow you to input your strategy rules and historical data, simulate trades, and analyze the results.

4. Run the Backtest: With your strategy, data, and environment ready, you can run the backtest. This involves simulating trades based on your strategy rules over the historical data and recording the results of each trade.

5. Analyze the Results: After running the backtest, you’ll have a set of results that show how your strategy would have performed. Analyze these results to understand the strengths and weaknesses of your strategy. Look at metrics like net profit, drawdown, win rate, and risk-to-reward ratio.

6. Refine Your Strategy: Based on your analysis, you may find areas where your strategy could be improved. Use these insights to refine your strategy and run the backtest again. This iterative process of backtesting, analyzing, and refining is key to developing a robust trading strategy.

Remember, while backtesting can provide valuable insights, it’s not a guarantee of future performance. Market conditions change, and a strategy that worked well in the past may not necessarily work in the future. Therefore, backtesting should be used as a tool to understand the potential risks and rewards of a strategy, rather than as a predictor of future returns.

How do I backtest a strategy for free?

Backtesting is a crucial step in validating your trading strategy. It allows you to evaluate the potential effectiveness of a strategy before risking any real capital. Fortunately, there are several tools available that allow you to backtest your strategies for free. Here’s how you can do it:

1. Define Your Trading Strategy: Before you begin backtesting, you need to have a clear, quantifiable trading strategy. This includes specific rules for when to enter and exit trades, what assets to trade, and how much capital to risk on each trade.

2. Choose a Backtesting Platform: There are several free backtesting platforms available. Some popular ones include TradingView, MetaTrader (MT4/MT5), and QuantConnect. These platforms offer free access to historical price data and powerful backtesting engines.

3. Input Your Strategy: Once you’ve chosen a platform, you’ll need to input your strategy. This usually involves coding your strategy rules using the platform’s scripting language. If you’re not familiar with coding, some platforms offer visual strategy builders or a marketplace where you can find pre-built strategies.

4. Run the Backtest: After inputting your strategy, you can run the backtest. The platform will simulate trades based on your strategy rules using historical price data and provide a report detailing the performance of the strategy.

5. Analyze the Results: Once the backtest is complete, analyze the results. Look at key performance metrics like net profit, drawdown, win rate, and risk-to-reward ratio. This can give you valuable insights into the potential risks and rewards of your strategy.

Remember, while backtesting can provide valuable insights, past performance is not necessarily indicative of future results. Always use backtesting as one tool in your trading toolkit, not as a guarantee of future success.

How do you backtest accurately?

Accurate backtesting is a cornerstone of validating a trading strategy. It involves simulating trades based on historical data and analyzing the results to evaluate the potential effectiveness of a strategy. Here are some key steps to ensure accurate backtesting:

1. Define Your Trading Strategy Clearly: A well-defined trading strategy is the foundation of accurate backtesting. This includes specific rules for when to enter and exit trades, what assets to trade, and how much capital to risk on each trade.

2. Use High-Quality Data: The quality of your data significantly impacts the accuracy of your backtest. Ensure you’re using high-quality, reliable data that’s relevant to your trading strategy and covers a sufficient time period.

3. Consider All Costs: Trading involves various costs such as spreads, commissions, and slippage. Ignoring these costs can lead to overly optimistic backtest results. Make sure to include all trading costs in your backtest to get a realistic estimate of profitability.

4. Avoid Overfitting: Overfitting occurs when a strategy is too closely fitted to the historical data and performs poorly on new data. To avoid overfitting, use out-of-sample data to validate your strategy and keep your strategy rules as simple as possible.

5. Use Appropriate Backtesting Software: The backtesting software should be capable of accurately simulating your trading strategy and providing detailed performance reports. Some popular backtesting platforms include MetaTrader, TradingView, and QuantConnect.

6. Analyze Various Performance Metrics: Don’t rely on a single metric to evaluate your strategy. Analyze various performance metrics like net profit, drawdown, win rate, and risk-to-reward ratio to get a comprehensive view of your strategy’s performance.

Remember, while backtesting can provide valuable insights, it’s not a guarantee of future performance. Market conditions change, and a strategy that worked well in the past may not necessarily work in the future. Therefore, backtesting should be used as a tool to understand the potential risks and rewards of a strategy, rather than as a predictor of future returns.

Why Choose Trade Nation for Forex Trading?

Trade Nation stands out as a preferred choice for Forex trading for several reasons. One of the key features that sets Trade Nation apart is its offering of fixed spreads. Fixed spreads provide certainty and predictability in trading costs, which can be particularly beneficial in volatile market conditions. This feature allows traders to plan their trading strategies more effectively, knowing that their trading costs will remain constant, regardless of market fluctuations.

In addition to fixed spreads, Trade Nation offers a range of other benefits:

1. Regulated Broker: Trade Nation is regulated by multiple financial authorities worldwide, providing a secure and reliable trading environment.

2. Comprehensive Trading Tools: The platform offers a suite of advanced trading tools and charts, aiding traders in making informed decisions.

3. Educational Resources: Trade Nation provides a wealth of educational materials, including webinars, articles, and guides, supporting traders at all levels in their trading journey.

4. Excellent Customer Support: Known for its responsive and helpful customer service, Trade Nation ensures traders have the support they need, when they need it.

For a more detailed analysis of Trade Nation’s offerings, you can refer to our comprehensive Trade Nation Broker Review. This review provides an in-depth look at Trade Nation’s services, helping traders make an informed decision about whether Trade Nation is the right broker for their trading needs. Remember, choosing the right broker is a crucial step in your trading journey.

The Role of Backtesting in Trading

Is backtesting good for trading?

Backtesting is indeed a valuable tool for trading, and here’s why:

1. Strategy Validation: Backtesting allows traders to test their trading strategies against historical data. This can provide a sense of how a strategy might perform under similar market conditions in the future, thereby validating its potential effectiveness.

2. Risk Management: By backtesting a strategy, traders can gain insights into various risk metrics such as maximum drawdown, volatility, and the risk-to-reward ratio. This can help in devising effective risk management techniques.

3. Performance Improvement: Backtesting can highlight the strengths and weaknesses of a trading strategy. Traders can use this information to refine and optimize their strategy, thereby improving its performance.

4. Confidence Building: A well-backtested strategy can give traders confidence in their approach, which can be crucial in maintaining discipline during trading.

5. Cost-Efficient: Backtesting allows traders to test their strategies without risking real capital. This can save traders from costly mistakes that could occur if untested strategies were implemented in live trading.

However, while backtesting is a powerful tool, it’s important to remember that it has its limitations. The most significant is that past performance is not necessarily indicative of future results. Market conditions can change, and a strategy that worked well in the past may not necessarily work in the future. Therefore, backtesting should be used as a tool to understand the potential risks and rewards of a strategy, rather than as a predictor of future returns.

How much backtesting is enough?

Determining the optimal amount of backtesting involves a careful balance. You want to ensure your strategy is robust and can handle various market conditions, but over-optimizing based on excessive historical data can lead to a strategy that is overfitted and performs poorly on new data.

Here are some considerations when deciding how much backtesting is sufficient:

1. Market Conditions: Your backtesting period should encompass a range of market conditions, including periods of high and low volatility, different economic cycles, and major market events. This helps ensure your strategy is robust and not just tailored to one specific type of market condition.

2. Frequency of Trading: The frequency of your trading can influence the amount of data needed for reliable backtesting. Strategies involving frequent trading may require less data, while those with infrequent trading may need more data to ensure a sufficient number of trades in the backtest.

3. Overfitting: Overfitting happens when a strategy is too closely tailored to the historical data, resulting in poor performance on new data. To avoid overfitting, use out-of-sample data to validate your strategy.

4. Stability of Results: If your backtest results are stable across different time periods, this can indicate that your amount of backtesting is adequate. If results vary widely across different time periods, it may signal the need for more backtesting or strategy refinement.

While backtesting is a powerful tool, it’s crucial to remember its limitations. Past performance is not necessarily indicative of future results, as market conditions can change. Therefore, backtesting should be used as a tool to understand the potential risks and rewards of a strategy, rather than as a predictor of future returns.

As we continue to explore the world of backtesting in the following sections, we’ll delve into its role in trading, its risks and limitations, and how to backtest strategies for free on different platforms.

How does backtesting help in risk management?

Risk management is a crucial aspect of trading, and backtesting plays a significant role in it. Here’s how:

1. Understanding Potential Losses: Backtesting allows traders to see the maximum drawdown or the largest drop in portfolio value that would have occurred with a particular strategy. This can help traders understand the potential losses they could face and plan their risk management strategies accordingly.

2. Evaluating Risk-Reward Ratio: Backtesting can provide insights into the risk-reward ratio of a strategy, which is the potential profit a trader could make for every dollar risked. A favorable risk-reward ratio is often a key factor in a successful trading strategy.

3. Stress Testing: Backtesting allows traders to stress test their strategies against extreme market conditions. This can help identify vulnerabilities in a strategy and make necessary adjustments to mitigate risk.

4. Position Sizing: Backtesting can help determine optimal position sizing, which is the amount of capital to risk on each trade. By analyzing the historical performance of a strategy, traders can decide how much capital to allocate to each trade to achieve their desired level of risk.

5. Stop-Loss and Take-Profit Levels: Backtesting can help identify optimal stop-loss and take-profit levels. These are pre-determined levels at which a trader will close a position to either limit potential losses (stop-loss) or secure profits (take-profit).

6. Portfolio Diversification: Backtesting multiple strategies or assets can provide insights into their correlation. This can help in creating a diversified portfolio, which is a common risk management technique.

Remember, while backtesting can provide valuable insights for risk management, it’s not a guarantee of future performance. Market conditions can change, and a strategy that worked well in the past may not necessarily work in the future. Therefore, backtesting should be used as a tool to understand the potential risks and rewards of a strategy, rather than as a predictor of future returns.

The Risks and Limitations of Backtesting

What are the risks of backtesting?

While backtesting is a powerful tool in a trader’s arsenal, it’s not without its risks. Here are some potential pitfalls to be aware of:

1. Overfitting: This occurs when a strategy is too finely tuned to past data and performs poorly on new data. Overfitting can give a false sense of security about a strategy’s effectiveness and lead to unexpected losses.

2. Data Snooping Bias: This bias occurs when a strategy appears to perform well because it has been tested on too many scenarios. The more scenarios a strategy is tested on, the more likely it is to find patterns that may not hold in the future.

3. Look-Ahead Bias: This happens when a strategy is tested using information that would not have been available at the time of trading. It’s important to ensure that your backtest only uses information that would have been known at the time of each trade.

4. Survivorship Bias: This bias can occur if your backtest only includes assets that have ‘survived’ until the present day. This can lead to overly optimistic results, as it ignores assets that may have performed poorly and been delisted.

5. Limitations of Historical Data: Past performance is not always indicative of future results. Market conditions can change, and a strategy that worked well in the past may not necessarily work in the future.

6. Ignoring Trading Costs: Backtests often overlook trading costs such as spreads, commissions, and slippage. Ignoring these costs can lead to an overestimation of a strategy’s profitability.

While backtesting is an essential part of strategy development, it’s important to be aware of these risks and take steps to mitigate them. This includes using out-of-sample data to validate your strategy, accounting for trading costs, and being wary of overfitting.

Exploring BlackBull Markets: A Comprehensive Guide for Forex Traders

BlackBull Markets is a New Zealand-based online Forex and CFD broker that has been gaining recognition in the trading community for its comprehensive offerings and commitment to transparency. Here’s what you need to know:

1. Regulation and Security: BlackBull Markets is regulated by the New Zealand Financial Markets Authority, providing a secure trading environment.

2. Trading Platforms: BlackBull Markets offers the popular MetaTrader 4 and MetaTrader 5 platforms, known for their advanced charting tools and automated trading capabilities.

3. Asset Selection: Traders have access to a wide range of assets including Forex, commodities, indices, and metals.

4. Account Types: BlackBull Markets offers multiple account types to cater to different trading needs. This includes ECN Standard, ECN Prime, and ECN Institutional accounts, each with different features and benefits.

5. Customer Support: BlackBull Markets prides itself on its responsive and multilingual customer support, available 24/6.

6. Educational Resources: BlackBull Markets provides a range of educational resources including webinars, articles, and guides to support traders at all levels.

For a more detailed analysis of BlackBull Markets’ offerings, you can refer to our comprehensive BlackBull Markets Broker Review. This review provides an in-depth look at BlackBull Markets’ services, helping traders make an informed decision about whether BlackBull Markets is the right broker for their trading needs.

Backtesting on Different Platforms

Does TradingView allow backtesting?

TradingView does indeed support backtesting. There are several ways that users can backtest strategies:

1. Bar Replay Feature: This feature allows traders to manually backtest strategies.

2. Automated Strategy Tester Program: This program lets traders use pre-built strategies or build their own using the TradingView programming language – Pine Script.

3. Deep Backtesting: This mode allows users to backtest strategies on all data available in TradingView’s data storage.

Backtesting is a method of determining whether or not your trading strategy has been profitable in the past. The process uses historical market data with specific strategy parameters or a specific trading setup. It’s a great way to fine-tune an already profitable strategy to work out how to make it even more profitable.

If you’re planning to use TradingView for running backtesting, consider upgrading to the TradingView PREMIUM plan. The PREMIUM subscription is tailored towards backtesting users – It offers all available historical data plus the most precise price action simulation.

Please note that backtesting a trading strategy in TradingView is straightforward, but it does require writing a few lines of code in PineScript. No prior coding knowledge is required to start backtesting immediately.

Additionally, if you open an account at BlackBull Markets and do one lot per month, you will get TradingView for free. This could be a great way to access TradingView’s features without incurring additional costs. Open an account at BlackBull Markets by clicking here.

Can I do backtesting in MT5?

Certainly, assuming you already have MetaTrader 5 (MT5) installed, you can indeed perform backtesting. Here’s a unique guide on how to do it:

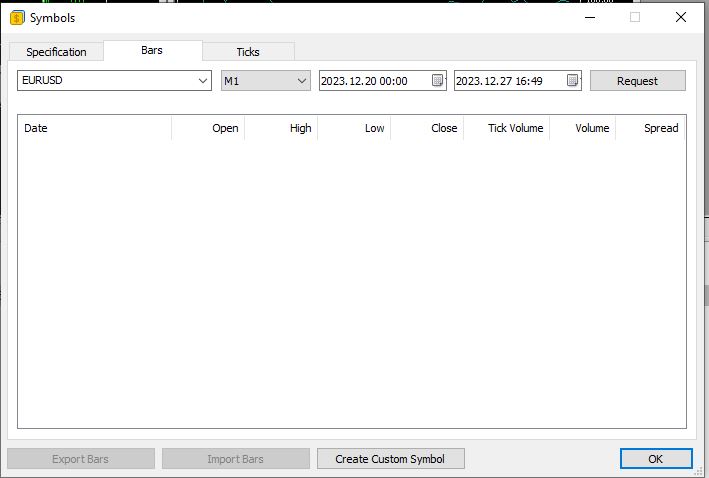

Step 1: Gather Your Data

For a valid backtest, you need as much historical data as possible. To download additional data, navigate to: View > Symbols.

Then select the currency pair for which you want to download data. After selecting the pair, click on the Bars Tab. Choose the timeframe of data you want to download, and then specify the starting and ending dates of the historical data. Finally, click the Request button to download the data.

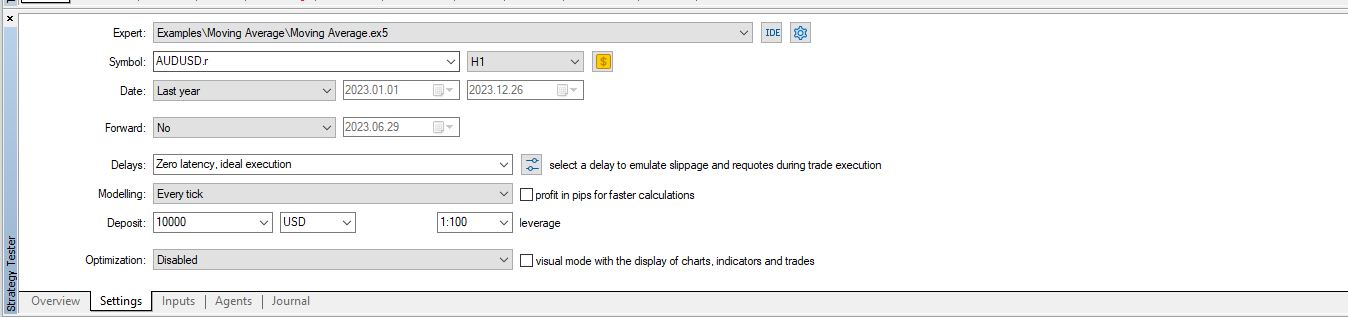

Step 2: Launch the Strategy Tester

You can find the Strategy Tester under the “View” menu. Select “Strategy Tester” to open it.

Step 3: Choose Your Trading Instrument

Pick the trading instrument you want to backtest. MT5 supports a variety of instruments, including forex, stocks, and commodities.

Step 4: Configure the Testing Parameters

Set up the testing parameters according to your strategy.

Step 5: Execute the Backtest

Once everything is set up, you can run the backtest and analyze the results.

Backtesting is a crucial first step in determining if your trading strategy has potential. It allows you to quickly run through historical data, providing you with much more data than if you were only trading in a demo or live account. Testing that might take months or years in demo trading can be completed in a matter of days or weeks with backtesting. Plus, you can practice a strategy when the markets are closed, making it an ideal training tool. So, it’s extremely beneficial to learn this skill, and MT5 is a good platform to start with.

Does MT4 have a strategy tester?

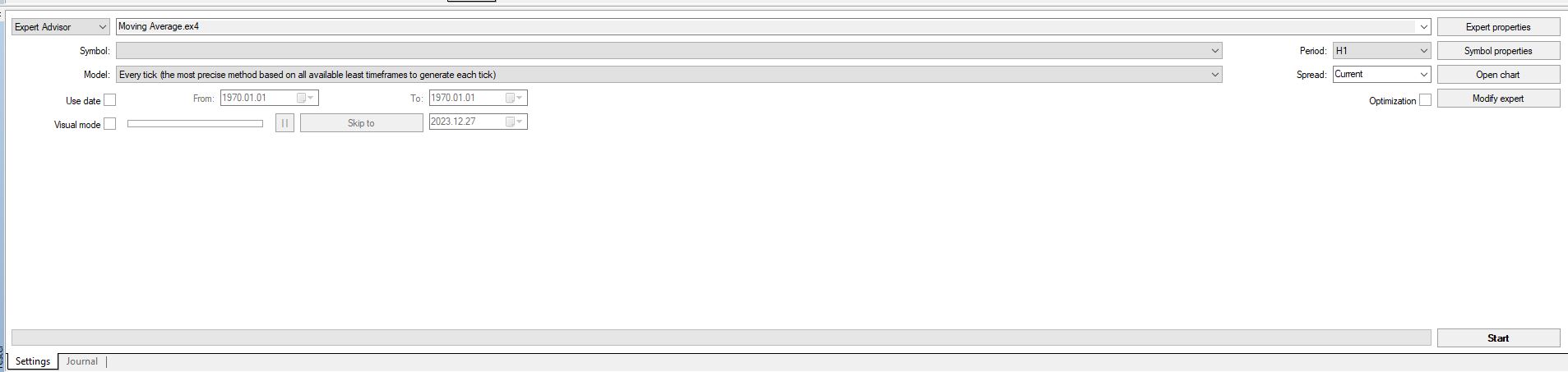

MetaTrader 4 (MT4) does have a strategy tester and it’s a powerful tool for testing your automated trading strategies. Here’s a unique guide on how to use it:

Step 1: Access the Strategy Tester

The Strategy Tester can be found in the View tab of the MT4 platform, or you can press CTRL + R on your keyboard.

Step 2: Select Your Trading Instrument

Choose the financial instrument you want to test your strategy on. MT4 supports a wide range of instruments including forex, indices, commodities, and more.

Step 3: Define Your Strategy Parameters

Set the parameters of your strategy. This includes the time period you want to test, the type of data to use (every tick, control points, open prices), and any other specific settings related to your strategy.

Step 4: Run the Strategy Tester

Click the “Start” button to begin the backtest. The Strategy Tester will run your strategy against the historical data and provide you with a detailed report.

Step 5: Analyze the Results

After the backtest is complete, you can analyze the results in the “Results”, “Graph”, and “Report” tabs. These tabs provide a wealth of information about your strategy’s performance, including profit and loss, drawdown, number of trades, and much more.

One unique feature of the MT4 Strategy Tester is the “Visual Mode”. If you check this option, you can watch your strategy trade in real-time (or sped up) on the charts. This can be a great way to visually validate your strategy’s logic and performance.

Remember, while backtesting can provide valuable insights, it’s not a guarantee of future performance. Always use sound risk management when trading live. Happy testing!.